The Tax Cuts and Jobs Act liberalized the rules for depreciating business assets. However, the amounts change every year due to inflation adjustments. And due to high inflation, the adjustments for 2023 were big. Here are the numbers that small business owners need to know.

Section 179 deductions

For qualifying assets placed in service in tax years beginning in 2023, the maximum Sec. 179 deduction is $1.16 million. But if your business puts in service more than $2.89 million of qualified assets, the maximum Sec. 179 deduction begins to be phased out.

Eligible assets include depreciable personal property such as equipment, computer hardware and peripherals, vehicles and commercially available software.

Sec. 179 deductions can also be claimed for real estate qualified improvement property (QIP), up to the maximum allowance of $1.16 million. QIP is defined as an improvement to an interior portion of a nonresidential building placed in service after the date the building was placed in service. However, expenditures attributable to the enlargement of a building, elevators or escalators, or the internal structural framework of a building don’t count as QIP and usually must be depreciated over 39 years. There’s no separate Sec. 179 deduction limit for QIP, so deductions reduce your maximum allowance dollar for dollar.

For nonresidential real property, Sec. 179 deductions are also allowed for qualified expenditures for roofs, HVAC equipment, fire protection and alarm systems, and security systems.

Finally, eligible assets include depreciable personal property used predominantly in connection with furnishing lodging, such as furniture and appliances in a property rented to transients.

Deduction for heavy SUVs

There’s a special limitation on Sec. 179 deductions for heavy SUVs, meaning those with gross vehicle weight ratings (GVWR) between 6,001 and 14,000 pounds. For tax years beginning in 2023, the maximum Sec. 179 deduction for heavy SUVs is $28,900.

First-year bonus depreciation has been cut

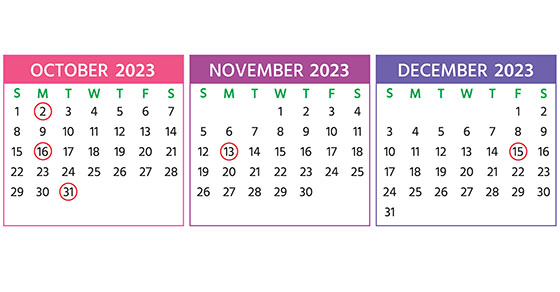

For qualified new and used assets that were placed in service in calendar year 2022, 100% first-year bonus depreciation percentage could be claimed.

However, for qualified assets placed in service in 2023, the first-year bonus depreciation percentage dropped to 80%. In 2024, it’s scheduled to drop to 60% (40% in 2025, 20% in 2026 and 0% in 2027 and beyond).

Eligible assets include depreciable personal property such as equipment, computer hardware and peripherals, vehicles and commercially available software. First-year bonus depreciation can also be claimed for real estate QIP.

Exception: For certain assets with longer production periods, these percentage cutbacks are delayed by one year. For example, the 80% depreciation rate will apply to long-production-period property placed in service in 2024.

Passenger auto limitations

For federal income tax depreciation purposes, passenger autos are defined as cars, light trucks and light vans. These vehicles are subject to special depreciation limits under the so-called luxury auto depreciation rules. For new and used passenger autos placed in service in 2023, the maximum luxury auto deductions are as follows:

- $12,200 for Year 1 ($20,200 if bonus depreciation is claimed),

- $19,500 for Year 2,

- $11,700 for Year 3, and

- $6,960 for Year 4 and thereafter until fully depreciated.

These allowances assume 100% business use. They’ll be further adjusted for inflation in future years.

Advantage for heavy vehicles

Heavy SUVs, pickups, and vans (those with GVWRs above 6,000 pounds) are exempt from the luxury auto depreciation limitations because they’re considered transportation equipment. As such, heavy vehicles are eligible for Sec. 179 deductions (subject to the special deduction limit explained earlier) and first-year bonus depreciation.

Here’s the catch: Heavy vehicles must be used over 50% for business. Otherwise, the business-use percentage of the vehicle’s cost must be depreciated using the straight-line method and it’ll take six tax years to fully depreciate the cost.

Consult with us for the maximum depreciation tax breaks in your situation.

© 2023